Описание файла

Бесплатно для зарегистрированных пользователей, членов Клуба и ВИП-членов.

Basically every problem in the US economy is because companies have too much power, new research argues

Competition is good. This might be the most basic tenet of economics. In a healthy economy, when one company is selling a product for well above what it costs to produce, other companies jump in that market to compete with them, reducing the resulting markup on goods. This is good for consumers and workers alike. Products are cheaper and more widely available, and more workers are needed to produce them.

But what happens if, for whatever reason, competition in an economy dwindles, and companies are able to ratchet up prices much higher than what it costs to produce them? It would have disastrous effects. Workers’ wages and employment rates would decline. People would switch jobs less often. Economic growth would slow.

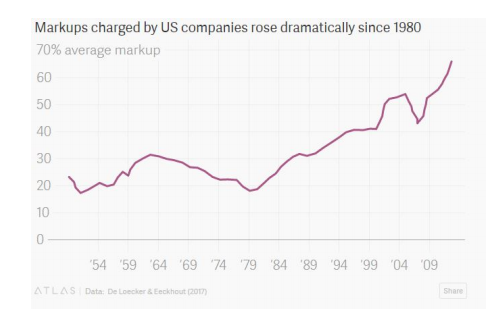

According to economists Jan De Loecker of Princteon University and Jan Eeckhout of the University College London, this is basically describes the US economy since 1980. In a recently released paper, De Loecker and Eeckhout analyzed the balance sheets of listed companies from 1950 to 2014. (In 2014, these firms accounted for around 40% of all sales.) They found that average markups, defined as the amount above cost at which a product is sold, have shot up since 1980. The average markup was 18% in 1980, but by 2014 it was nearly 70%.

Higher markups suggest an increase in what economists refer to as “market power.” In a perfectly competitive market, in which competitors offer the exact same product, companies have no market power. If one company charges higher prices than others, they will lose all of their business to cheaper competitors. In a perfectly competitive market, the only way to justify a higher markup is to make a product more efficiently.

But most markets are not perfectly competitive, and most firms have some form of market power that allows them to charge a markup. For example, the lone gas station in a small town is able to charge more because people have no other choice. Apple is able to charge a significant markup on iPhones thanks to a combination of the uniqueness of its product and customer loyalty.

If De Loecker and Eeckhout are right that market power is increasing, this has significant downsides. The most profitable thing for a company with market power to do is make less of their product and increase the price—akin to what the OPEC cartel does thanks to its power in the oil market. Reduced production means fewer workers are needed and more of revenue goes to owners instead of labor.

One concern with De Loecker and Eeckhout’s analysis, raised by economist Tyler Cowen, is that higher markups don’t necessarily imply more market power. It is conceivable that there are larger upfront costs to starting a company today than in the past, and that higher markups are necessary to make up for this. Economist Noah Smith provides an excellent review of other criticisms of the paper.

ВНИМАНИЕ!

Полностью статья изложена в PDF-файле, который доступен бесплатно для зарегистрированных пользователей, членов и ВИП-членов Клуба Знаний Мебельного Бизнеса.

Если Вы ещё не зарегистрированы у нас на площадке, сделайте это сейчас здесь - займет всего 1 мин.

Вам также станут бесплатно доступны более 2000 материалов по маркетингу, мерчандайзингу, управлению, продажам, должностные инструкции, фото, видео.

Жалоба